Lifting The Corporate Veil And Its Legal Impact In Business

As businesses are being established either as Limited Liability Company (LLC) or Corporate Entity, separate Legal entities are also formed. This formation is mainly to reduce the liabilities of its members from the obligations of the business. Some of these obligations include the purchase of goods and services. This also includes the signing of documents and contracts, filing litigation, recovery of debt and other similar activities. In law, legal entities simply mean individuals, companies, corporations, or organizations that have legal rights and obligations. They have the same authorities and rights that one has in his/her personal life.

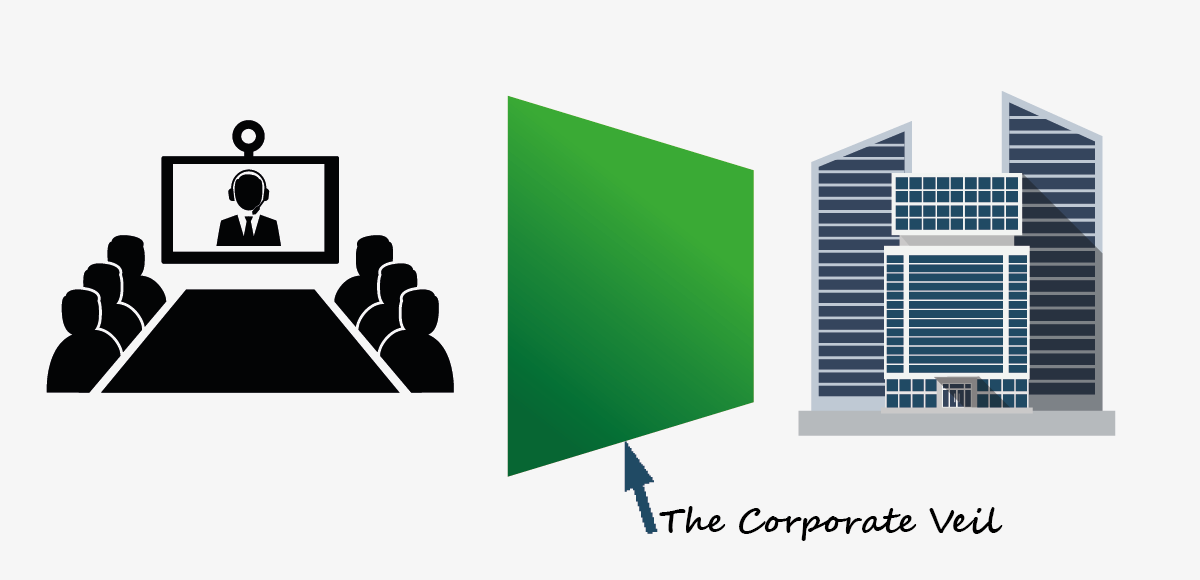

When a business is established as a separate legal entity, if eventually the business gets sued, declared bankrupt or even defaults on a loan, the creditors cannot lay claims on the owner of the business or personal assets. In legal terms, the separation of a person from a corporation is called “the corporate veil”. This also includes the protection of the person’s properties in case of company debt. Even as a business owner if you do not take steps to protect the corporate veil, you may no longer receive personal liability protection.

What is a Corporate Veil in Legal Laws?

According to the Business Dictionary, the corporate veil is “a legal concept that separates the personality of a company from the personalities of its shareholders. It protects them from being personally liable for the debts and obligations of the company. This protection is not ironclad or impenetrable.” However, if a court decides that the activities of a company were not carried out in compliance with the legal laws in business (or that it was just a facade for illegal activities), it may hold the shareholders personally liable for the company’s obligations under the legal concept of “lifting the corporate veil”.

What is Lifting the Corporate Veil in Business?

These protections are not absolute in legal laws. As previously said, when a court of law determines that a business’ operations are not carried out in compliance with the requirements of the relevant laws, it may hold its shareholders personally liable for the company’s responsibility. This concept is known as “lifting” popularly known as “piercing the corporate veil”. Piercing the corporate veil refers to a situation in which courts put aside limited liability. This means that the court can hold the corporation’s shareholders or directors personally liable for the company’s actions or debts.”

The concept of the corporate veil is intertwined with the concept of limited liability. The LLC is considered completely separate from the owner and manager of the business. Therefore, the owners/managers cannot be held responsible for the company’s actions. Ordinarily, owners of these types of businesses are protected from liability due to the corporate veil. But this protection isn’t absolute and in some cases, the corporate veil may be pierced. This happens when the owner fails to treat the company as a separate business entity. Also, lifting the corporate veil happens when the company’s owners use it to commit fraud or other illegal action(s).

Failure of business owners especially small businesses to adhere to the legal laws in businesses is one of the common reasons for the lifting of the corporate veil. For instance, corporations are required to obey corporate bylaws, host annual meetings with stakeholders, and keep minutes of board sessions. These requirements may look easy to follow but can also be easily overlooked and can expose the business to have its corporate veil lifted.

There are other mistakes that business owners make that can lead to the lifting of the corporate veil, these include:

- Using the corporation to promote fraudulent activities.

- Confusing business activities, assets, or management with personal activities and accounts.

- The debt-to-equity ratio (When a business is in large debt with very little capital, this could lead to the lifting of the corporate veil).

- Neglecting corporate formalities, such as the ones discussed above.

- Insolvency at the time of the disputed transaction, (here the company is aware of its inability to repay debt and still entered into a deal.

- Owners and managers fail to fulfil their obligations and duties as outlined in governing documents like the bylaws.

If a court lifts a business’s corporate veil, the owners shall be held personally liable for the company’s faults. This implies that the company’s creditors either individuals or institutions have the right to seize the assets of the owners. Assets such as properties, bank accounts, or investments can be used to settle the debts of the company. However, the courts will not impose personal liability on individuals who are not responsible for the company’s wrongful or fraudulent activities.

Most business owners are the ones that take a large part of the impact when a business corporate veil is lifted. This is so because they control the company and the assets that are either taken or seized are theirs. Looking at it from a business point of view, business owners should not neglect their obligations. This may cause the company to file for bankruptcy and ultimately close. In addition, stakeholders are at a loss as all their investments can be taken in case of debt or other causes of lifting the corporate veil.

The resources of a business should be used to run the daily operations of the business. It should not be used to settle issues that are personal contrary to the bylaws of running a company. The corporate veil of a company provides it with a powerful avenue for businesses and enterprises to thrive. This is because it protects business owners and investors from direct corporate assault and avoidable litigation.

However, the law will not permit directors to hide under the corporate veil or use it as an excuse to defraud the company or its creditors. Hence the Court will readily lift the corporate veil to ensure that creditors recover their money directly from such directors.

Conclusion

Lifting the corporate veil of a company regardless of its size will require the help of a business attorney. In Nigeria today especially in urban cities like Lagos, Abuja, Kano, and Port Harcourt there are many business attorneys but you need to work with the best and Greengold Attorneys is one of the top law firms in Abuja, Nigeria. A trial will convince you. Because you deserve the best, contact us today and let us handle your legal issues.